The New Base Layer

How energy systems, global currencies, crypto settlement rails, and physical markets are realigning

FFG’s targets are pressing against the edge of current reality.

Separate systems.

Interlocked trajectories.

Energy. Currency. Settlement rails. Physical supply.

Different domains. Same compression.

This week’s work tracks what is changing beneath visibility—before language, pricing, or consensus can catch up.

It represents only a surface layer of the work held inside FFG’s private research archive.

Remote Viewing the Future of Uranium: Quantum Computing, Space Data Centers, and Self-Assembling Nanotech

Uranium is no longer just fuel. It becomes the foundation layer.

Remote viewing data points to uranium-235 as the energy backbone of the next technological stack—space-based data centers, quantum-AI systems, autonomous manufacturing, and early large-scale human-machine integration.

The trajectory shifts from gradual to exponential: self-assembling nanotech constructing orbital platforms, compact nuclear reactors driving off-world computation, quantum systems reshaping medicine and climate modeling, and AI-run factories replacing manual labor.

The timeline converges quickly. Major breakthroughs within a decade. System-wide adoption by 2036.

Not a single invention.

An energy regime shift.

Who controls the fuel layer?

Special Update with Martee Hibbs: Discussion on Uranium, Space Travel, and Strategic Positioning

What began as a blind remote-viewing target on Uranium-235 widened into a different system.

Across independent sessions, viewers described the same architecture: orbital manufacturing, nuclear-powered facilities, advanced propulsion, and space-based computing—built for sustained activity beyond Earth.

Martee Hibbs, Dick Allgire, and Edward Riordan then trace these signals across domains already in motion: classified energy research, military-industrial development, geopolitical positioning in Greenland and Canada, and early institutional movement in uranium and silver markets.

That would place future industrial capacity not near cities or ports, but near whoever secures fuel, materials, and orbital access.

This is not disclosure.

It is infrastructure forming in advance.

Energy first.

Manufacturing next.

Then movement.

The rest follows.

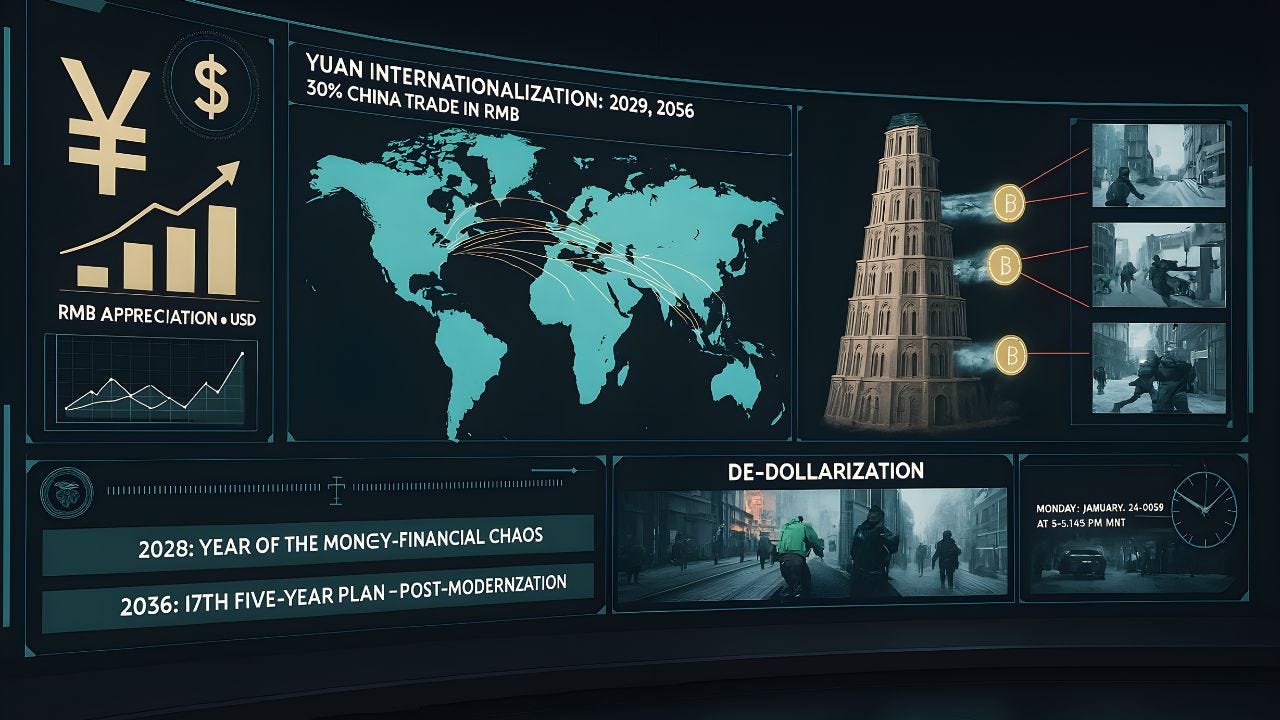

Remote Viewing the Yuan: What Our Blue Sky Team Sees Coming by 2036

Currencies don’t collapse in public. They are replaced quietly, through trade routes, settlement systems, and infrastructure most people never see.

When our Blue Sky remote viewing team examined the trajectory of the Chinese Yuan through 2036, they encountered patterns of accelerating international adoption, digital currency expansion, and a gradual weakening of the dollar’s role as global lubricant. What emerged was not a sudden overthrow, but a long rebalancing—trade shifting first, reserve behavior second, public recognition last. If the signal is accurate, the future of money will not arrive as a crisis headline.

It will arrive as a new default.

Reserve status becomes a function of settlement infrastructure.

Crypto Masterminds: Three RWA Plays for the $11 Trillion Tokenization Revolution

Tokenization is no longer a theme. It’s a capital rotation.

FFG’s Crypto Masterminds break down three institutional entry points into real-world assets: Ondo as the compliance gateway, Maple as the revenue engine, and Injective as high-speed settlement infrastructure.

The session moves past narrative into structure—market levels, token design, institutional partnerships, and regulatory tailwinds reshaping the RWA landscape. With the NYSE entering tokenization and legal clarity expanding, the panel frames this shift as a new market regime, not a cycle.

In that model, capital flows toward protocols that function as utilities, not narratives.

Altcoin leadership, they argue, will belong to protocols that can absorb institutional scale.

Not hype—structure.

Positioning before it becomes obvious.

Bullrun Bunker: Building Wealth with Pristine Collateral While Others Chase Volatility

Most market cycles reward speed.

System changes reward position.

In this episode, Jordan examines how capital is migrating toward assets that function less as trades and more as structural ballast: Bitcoin, Ethereum, and gold—what BlackRock terms pristine collateral.

The focus is not upside narratives, but survivability. How assets behave when leverage clears, when regulation hardens, when settlement systems change form.

When collateral regimes change, trading strategies stop compounding wealth. Balance-sheet positioning does.

He outlines accumulation frameworks, indirect exposure through public equities and tokenized gold, and the quiet role of infrastructure protocols like Chainlink in stitching new financial rails together.

Volatility remains. Narratives rotate.

But collateral endures.

Martee Hibbs’ Weekly Update: The Oracle Pattern Points to Critical January Inflection Points

January isn’t acting like a normal month. It’s acting like a boundary.

In this update, Marty Hibbs maps a rare convergence: market timing models, technical resistance, and physical-market stress all compressing into the same window. Stocks are stalling near cycle highs. Gold is pressing into its upper target zone. Silver is moving into scarcity pricing. Bitcoin is correcting into structural support.

What stands out isn’t one chart.

It’s the alignment.

Physical metals are decoupling from paper markets. Premiums are no longer noise—they’re signals. Across assets, late-stage momentum is colliding with physical constraints.

Market tops matter less than what replaces the liquidity structure that supported them.

Markets don’t usually turn loudly.

They tighten first.

FFG Podcast: How Synchronicities Guide Advanced Remote Viewers to Breakthrough Insights

Some targets deliver data.

Others rearrange the person who views them.

In this episode, Dennis Nappi II revisits his remote viewing work on the Ark of the Covenant—not as an artifact, but as a system tied to consciousness, information transfer, and long-cycle human conditioning. Guided by a series of synchronicities and later corroborated by historical intelligence files, the project blurred the boundary between ancient technology, cognition, and something that appears to operate outside linear time. What emerged was not certainty, but a pattern: information seeded across generations, shaping civilizations long before its effects become visible.

Not proof.

But a signal that some intelligence systems do not age.

Where the Lines Converge

Energy systems are re-platforming.

Settlement is being rebuilt.

Capital is moving toward tokenized rails.

Physical markets are asserting constraints.

These are not separate stories.

They are the same transition, viewed from different layers.

Whether every forecast resolves exactly as outlined is for time to decide. What is already clear is the direction of travel.

And the cost of noticing it late.

Future Forecasting Group is comprised of the best non-military remote viewing team in the world, with decades of experience and a track record to match.

Disclaimer: Informational only. Not financial or legal advice. Analysis is speculative. Digital assets carry risk. FFG assumes no liability for actions taken.

This framing of uranium as the infrastructure layer rather than just fuel is honestly one of the cleaner takes I've seen on the energy transition. I've been folowing the tokenization of physical assets for a bit now and the convergence with energy security is wild. The question of who controls the fuel layer might end up mattering more than who controls the computational layer tbh.